“Good design is as little design as possible.”

— Dieter Rams

One of the biggest challenges that led me to work with blockchain and crypto was the opportunity to expand the reach of a technology with immense emancipatory potential. The ability to operate without relying on traditional actors such as nation-states or central banks, and to create a decentralized financial network where users are both operators and overseers of transactions, is truly transformative. A network where trust and security come from within the system itself.

During my interview for Bitso, I asked the team why they were working with blockchain, and specifically, why Bitso. One person said, “Because I enjoy the challenge of democratizing technology.” Another said, “I like working with people who are at the cutting edge of technology and creating great design.” The last added, “Thanks to blockchain and crypto, I can help my family and send money to them in another country freely and without barriers.” It was at that moment I knew I was making the right decision.

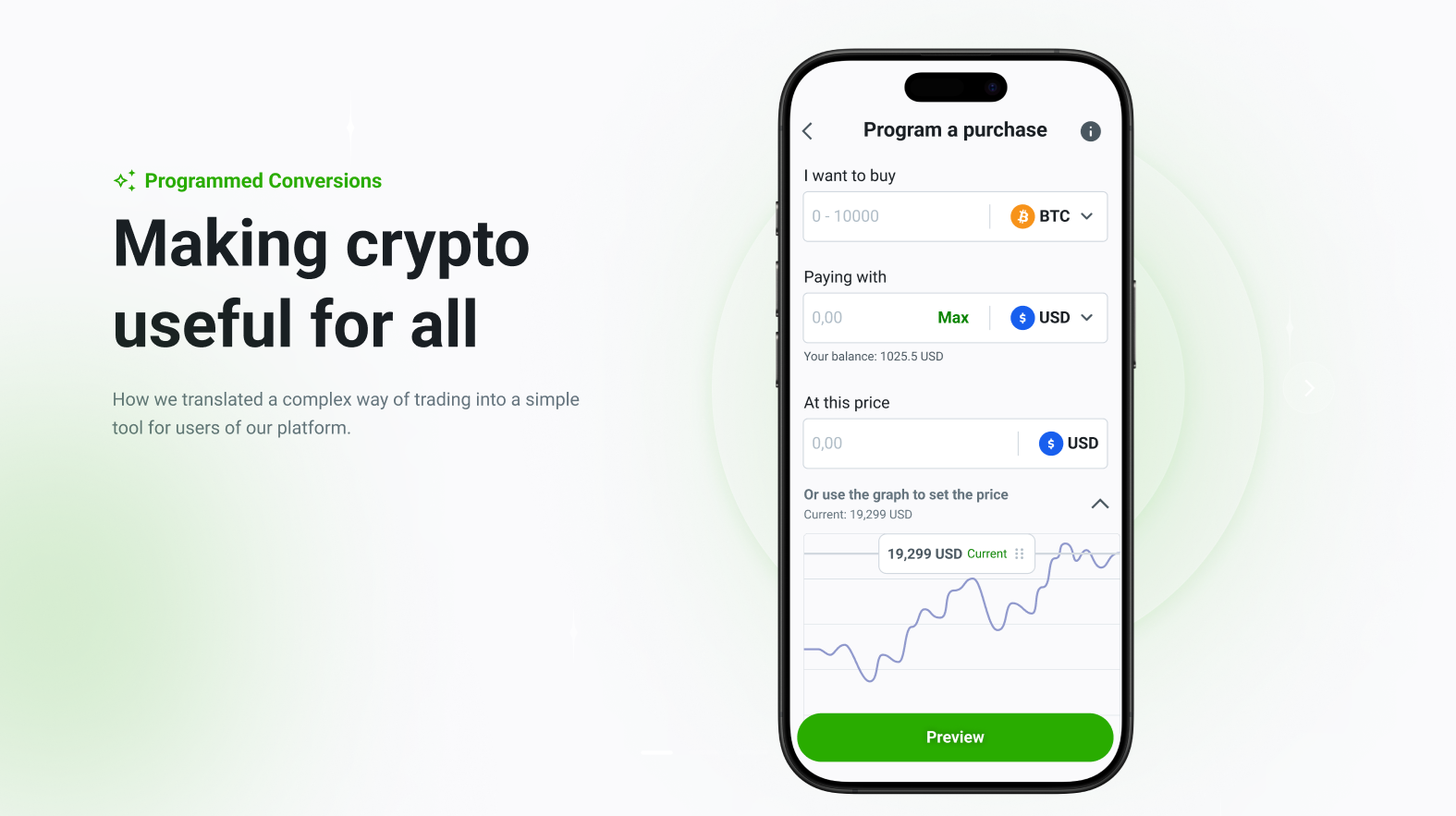

The challenge with blockchain and crypto lies in its complexity. Since the technology comes from the technical side, it can be difficult to grasp for those without specific knowledge of code, formats, or applications. Wallets and exchanges are created to broaden access, but they don’t always succeed in simplifying operations. In 2023, we had the opportunity and challenge to translate a complex trading process—Limit Orders—into one that was simpler and more accessible for everyone: Programmed Conversions.

Bitso has two applications: one simpler, with fewer features, used by around 3 million people, and another more advanced, Bitso Alpha, more complex and with more options, used by approximately 500,000 users. We identified a demand from users of the more widely used app, who had less technical knowledge of markets and crypto operations, to have more buying and selling tools in the popular app, and within that demand, a business opportunity.

To achieve this, we needed to simplify the experience of a complex operation like Limit Orders—a way of converting crypto by betting on a desired future price—and make it more understandable for people who are less familiar with markets. We started by talking to them: we conducted a mass survey and then in-depth interviews with Bitso users of different ages, genders, and socioeconomic levels.

From those conversations, we learned explicit things, like how Bitso users, as they become more familiar with the platform, want more advanced tools to do more. We also discovered more subtle aspects, such as the metaphors they use to describe their operations. For example, users refer to crypto as goods in a marketplace: objects that are “bought” and “paid for” with others, much like an online shopping site where you select products, add them to your cart, and in the final step, pay with a credit card.

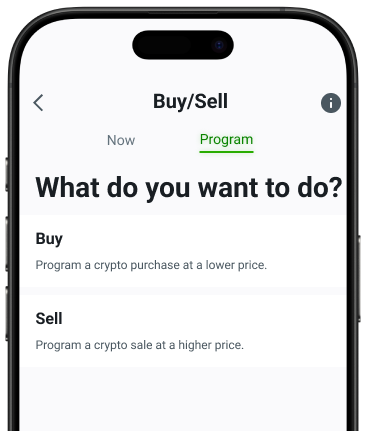

Based on this understanding, we decided to frame the currency conversion experience—the transformation of one asset into another—as a “purchase” or “sale” of assets.

How did we do this? By breaking the process down in the UX, even though, behind the scenes, it was the same operation: a conversion. To clarify this, we added an additional screen to the flow to help users focus on the transaction and reduce confusion such as, “Which asset am I giving, and which am I receiving?” Adding complexity to the flow resulted, paradoxically, in simplifying it.

Once in the purchase screen, the experience narrative had to be flexible yet clear enough to be followed in any order, and still allow the user to complete the operation correctly. Although the fields would auto-fill once two out of three were completed, the terms of the operation needed to be modular, interchangeable, and scalable to be understood. Like a Choose Your Own Adventure book, regardless of where you start—the beginning, the middle, or the end—the system would complete the rest for you, and you’d still understand what you’re doing. “I want to buy, paying, at this price,” or “At this price, I want to buy, paying,” and so on.

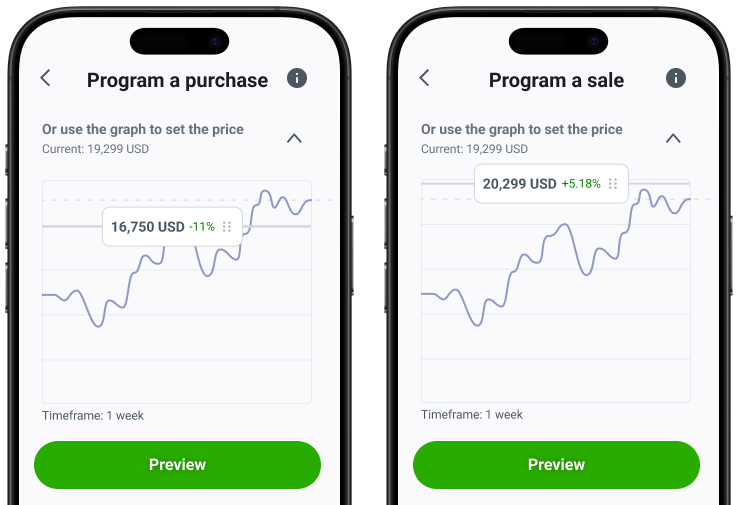

Finally, we added an interactive chart that provides additional context to the transaction (like the historical price of the currency) and allows users to select the target price directly on the chart. Within the range of a thumb’s movement, we had to decide how to tell the story. With all the context provided, we designed a chart where users could set their target price for buying or selling.

Following the buy/sell metaphor, the chart adapts to show in green if the user is making a favorable transaction (buying at a lower price or selling at a higher one) or, in red, if they are doing the opposite, possibly by mistake. We reduced the text to its bare minimum, so users could understand the situation at a glance when making a decision that could result in either a gain or a loss.

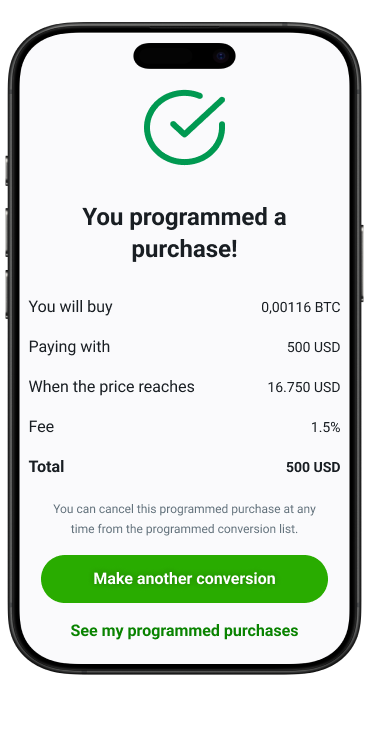

In six months, through multiple conversations between users, designers, engineers, data specialists, and other professionals, we successfully launched this product: a “translation” of a complex trading tool—Limit Orders—into a simpler, more democratic one: Programmed Conversions.

During the development of this product, I highlight the importance of listening to the user community and adapting the product to meet their real needs as key drivers. Involving less experienced users from the beginning allowed us to simplify complex processes and validate our hypotheses, making advanced tools more accessible to a broader audience. Constant feedback was essential for adjusting the design and ensuring the experience remained intuitive without sacrificing functionality.

Additionally, adapting technical language to a more approachable and accessible tone can bridge the gap between the complexity of cryptocurrencies and the everyday concepts of users. Simplifying workflows while keeping options for more advanced users, combined with a pedagogical design approach, empowered more people to engage with complex operations, ultimately increasing adoption and improving the overall user experience.